How I Mastered Renovation Funds Without Breaking the Bank

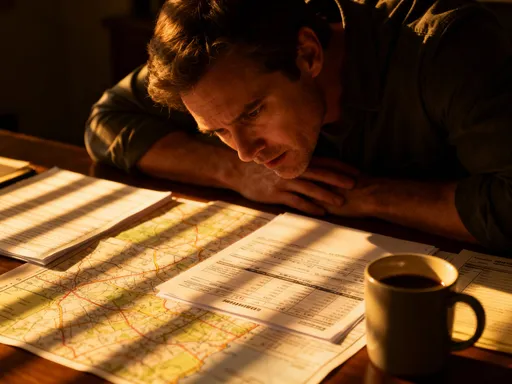

So you’ve decided to renovate—exciting, right? But then reality hits: the budget. I’ve been there, standing in a half-demolished kitchen, wondering how I’d pay for both materials and sanity. What I learned wasn’t from a finance guru, but through trial, error, and one serious spreadsheet obsession. This is how I planned smart, avoided costly traps, and kept my dream project on track—all while protecting my long-term financial health. It wasn’t about cutting corners or living on instant noodles for months. It was about making deliberate, informed decisions that balanced ambition with responsibility. And the best part? You don’t need a six-figure income or a trust fund to do the same.

The Renovation Reality Check

Renovations are emotionally charged events. They represent progress, comfort, and personal expression. A fresh coat of paint, a modernized bathroom, or an open-concept living area can transform not just a house, but a lifestyle. Yet, beneath the excitement lies a financial reality that catches many homeowners off guard. According to industry data, nearly 60% of renovation projects exceed their initial budget, with average overruns ranging from 10% to 30%. In some cases, especially with full-scale kitchen or bathroom remodels, cost overages can surpass 50%. These aren’t just inconvenient surprises—they can strain household finances, deplete emergency savings, or lead to high-interest debt.

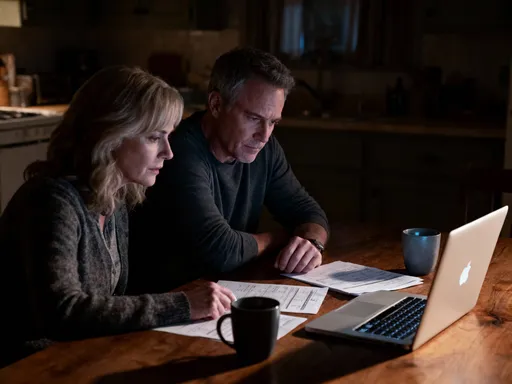

The root of the problem often lies in how people approach renovation funding. Many treat it as a one-off expense, separate from their broader financial picture. They budget for cabinets and countertops but fail to account for structural adjustments, permit delays, or unexpected plumbing issues. This fragmented thinking creates a false sense of control. The truth is, every dollar spent on a renovation is a dollar not saved for retirement, not invested in education, or not reserved for future emergencies. That’s why it’s essential to view renovation funds not as an isolated project cost, but as a strategic allocation within a larger financial plan. Treating it this way forces discipline, encourages prioritization, and reduces the risk of financial regret.

Consider the case of a family in the Midwest who decided to remodel their basement into a guest suite and home office. They allocated $35,000 based on initial contractor estimates. But halfway through, they discovered outdated wiring that required full replacement—an additional $8,000 expense. They also upgraded flooring and lighting beyond their original plan, adding another $5,000. With no buffer in place, they had to use a credit card with a 19.99% APR to cover the gap. Over the next three years, they paid nearly $3,000 in interest alone. What began as a quality-of-life improvement became a long-term financial burden. This scenario is not unique. It underscores the danger of emotional decision-making and the importance of integrating renovation planning with overall financial health.

Defining Your Renovation Fund: Beyond the Obvious

When most people think of a renovation budget, they picture visible costs: flooring, cabinetry, fixtures, and labor. But a truly comprehensive renovation fund includes much more. Permits, inspections, design consultations, dumpster rentals, and even temporary accommodations if the project disrupts daily life—all of these belong in the financial equation. Perhaps most critical is the emergency buffer, typically recommended at 10% to 20% of the total estimated cost. This reserve is not optional; it’s a financial safety net that prevents minor setbacks from becoming major crises.

Equally important is the distinction between needs and wants. A leaking roof or outdated electrical system qualifies as a need—addressing it protects the home’s integrity and safety. On the other hand, a walk-in pantry with custom shelving or imported Italian tiles may be a want—desirable, but not essential. Prioritizing needs ensures that limited funds are used where they matter most. It also prevents the common pitfall of spending heavily on aesthetic upgrades while neglecting structural or functional issues that could lead to bigger expenses down the road.

Mapping renovation goals to realistic funding requirements starts with a clear vision. Homeowners should begin by listing all desired projects and categorizing them by urgency and impact. A bathroom update that improves accessibility for aging family members may rank higher than a luxury backsplash. Once priorities are set, each item should be researched for average costs in the local market. Online tools, contractor quotes, and home improvement databases can provide reliable benchmarks. From there, a phased approach may be the most financially sound strategy—completing high-priority projects first and saving for others over time. This method avoids the pressure of financing everything at once and allows for better cash flow management.

Another often-overlooked aspect is the opportunity cost of using certain funds. For example, withdrawing from a retirement account to pay for a kitchen remodel may seem convenient, but it sacrifices compound growth and may trigger tax penalties. Similarly, using emergency savings for renovations leaves the household vulnerable to unexpected events like job loss or medical bills. A well-defined renovation fund respects these trade-offs and ensures that one financial goal doesn’t undermine another.

Funding Strategies That Actually Work

Where should the money for a renovation come from? This is one of the most critical financial decisions homeowners face. The answer depends on individual circumstances, including income stability, existing debt, home equity, and time horizon. There is no one-size-fits-all solution, but several realistic funding strategies have proven effective when applied with discipline.

One of the most common and accessible options is tapping into home equity. A home equity loan or line of credit (HELOC) allows homeowners to borrow against the value they’ve built in their property. These loans often come with lower interest rates than personal loans or credit cards because they are secured by the home. However, this also means the home is at risk if payments cannot be made. A fixed-rate home equity loan provides predictable monthly payments, making it easier to budget, while a HELOC offers flexibility—funds can be drawn as needed, similar to a credit card. The key is to use these tools responsibly, borrowing only what is necessary and avoiding the temptation to treat home equity as free money.

Another strategy is using emergency savings, but only if the fund is sufficiently large. Financial advisors generally recommend keeping three to six months’ worth of living expenses in liquid savings. If a renovation is planned well in advance, setting aside a portion of monthly income into a dedicated savings account can build the necessary funds without compromising financial security. This approach, often called “self-financing,” eliminates interest costs and avoids debt. However, it requires patience and consistent saving behavior—qualities that don’t come easily to everyone.

Personal loans are another option, particularly for smaller projects or when home equity is not available. These unsecured loans typically have fixed interest rates and repayment terms ranging from two to seven years. While convenient, they often carry higher rates than secured loans and can impact credit utilization if not managed carefully. It’s important to shop around and compare offers from multiple lenders to secure the best possible terms. Some credit unions and online lenders offer competitive rates for borrowers with strong credit histories.

For those with limited immediate funds, a phased renovation approach can be both practical and financially sustainable. Instead of completing the entire project at once, homeowners can break it into stages—such as upgrading plumbing and electrical systems one year, followed by flooring and finishes the next. This spreads out costs over time, reduces financial pressure, and allows for adjustments based on changing priorities or market conditions. It also provides the opportunity to save between phases, avoiding the need for large loans.

Balancing Growth and Protection

Some homeowners consider investing to grow their renovation fund, especially if the project is several years away. While this idea has merit, it comes with significant risks that must be carefully weighed. The core challenge is the time horizon. Renovation funds are typically needed within a few years, which classifies them as short- to medium-term goals. Investments like stocks or mutual funds, while capable of strong long-term returns, are subject to market volatility. A downturn just before the renovation begins could erase months or even years of gains, leaving the homeowner underfunded at the worst possible time.

A more prudent approach is to prioritize capital preservation over aggressive growth. For funds needed within one to three years, low-volatility options are preferable. High-yield savings accounts, certificates of deposit (CDs), and short-term bond funds offer modest but stable returns with minimal risk. These instruments protect the principal while still earning interest, ensuring that the money will be available when needed. Laddering CDs—spreading investments across multiple maturity dates—can provide both liquidity and slightly higher yields.

For those with a longer timeline, say four to seven years, a balanced asset allocation may be appropriate. This could include a mix of bonds, dividend-paying stocks, and index funds, with the exact mix depending on risk tolerance and financial goals. As the renovation date approaches, the portfolio should gradually shift toward more conservative holdings to lock in gains and reduce exposure to market swings. This strategy, known as a “glide path,” mirrors the approach used in target-date retirement funds and helps maintain a balance between growth and protection.

Liquidity is another crucial factor. Renovation funds must be accessible when needed. Illiquid investments, such as real estate or private equity, are unsuitable because they cannot be quickly converted to cash without potential losses. Even some mutual funds may have redemption fees or settlement periods that delay access. Therefore, the investment strategy should emphasize accounts that allow penalty-free withdrawals and same-day or next-day fund availability.

The Hidden Costs Nobody Talks About

Even the most carefully planned budgets can be derailed by hidden costs—expenses that are rarely discussed but frequently encountered. These include permit fees, inspection costs, utility disconnections, and waste removal. While individually small, they can add up quickly. For example, a building permit might cost $500 to $2,000 depending on location and scope, while a dumpster rental for debris could run $300 to $800. Failing to account for these items creates an immediate budget shortfall.

Supply chain delays are another growing concern. In recent years, global disruptions have led to extended lead times for materials like appliances, windows, and specialty fixtures. A delayed shipment can stall a project for weeks, increasing labor costs if contractors must return multiple times. Some homeowners end up paying rush fees to expedite delivery, adding hundreds or even thousands to the total cost. To mitigate this risk, it’s wise to order long-lead items early and build buffer time into the project schedule.

Design changes mid-project are a common source of overspending. The initial plan may seem perfect, but once demolition begins, new ideas emerge. “While we’re at it, let’s move the wall” or “Maybe we should upgrade to quartz countertops” are phrases that can quickly inflate a budget. Emotional spending—choosing premium finishes or luxury brands out of desire rather than necessity—also contributes to cost overruns. The best defense is a clear, written scope of work agreed upon with the contractor before construction begins. Any changes should go through a formal change order process, with updated cost and timeline estimates.

Contractor selection plays a major role in cost control. While the lowest bid may seem attractive, it can lead to subpar work, hidden charges, or project abandonment. Vetting contractors thoroughly—checking licenses, reading reviews, and requesting references—helps avoid these pitfalls. Fixed-price contracts, where the total cost is agreed upon upfront, offer more predictability than time-and-materials agreements, which can escalate with unforeseen work. A detailed contract should include specifications, timelines, payment schedules, and warranty terms to protect both parties.

Smart Spending: Maximizing Every Dollar

Stretching a renovation budget doesn’t mean sacrificing quality. It means making strategic choices that deliver value without waste. One of the most effective techniques is timing. Purchasing materials during off-peak seasons—such as buying flooring in winter or appliances during holiday sales—can yield significant discounts. Retailers often offer promotions to clear inventory, and contractors may be more willing to negotiate rates when demand is low.

Bulk purchasing is another way to save. Buying all tiles, lighting fixtures, or cabinet hardware at once often qualifies for volume discounts. Even small savings per item compound into meaningful reductions when applied across an entire project. Some suppliers offer bundled packages for full-room renovations, which can be more cost-effective than buying components separately.

DIY efforts, when done safely and within skill level, can also reduce labor costs. Painting, demolition, or installing simple fixtures are tasks many homeowners can handle with proper preparation. However, electrical, plumbing, and structural work should always be left to licensed professionals. Attempting these without expertise can lead to safety hazards, code violations, and costly repairs. The goal is not to do everything yourself, but to identify areas where personal effort adds value without risk.

Negotiating with vendors is often overlooked but can yield substantial savings. Many contractors build in a margin for negotiation, especially if they are eager for work. Asking for itemized quotes allows homeowners to compare line items and identify areas for adjustment. Sometimes, choosing a slightly different material or finish can reduce costs without compromising the overall look. Open communication and a respectful approach increase the likelihood of reaching a mutually beneficial agreement.

Long-Term Impact: Renovation as Financial Leverage

When done thoughtfully, a renovation can be more than a home improvement—it can be a strategic financial move. Certain upgrades, such as kitchen remodels, bathroom renovations, and energy-efficient improvements, have been shown to deliver strong returns on investment (ROI) when it comes time to sell. According to national remodeling reports, a mid-range kitchen remodel recoups approximately 70% to 80% of its cost at resale, while bathroom updates can return 60% to 70%. These figures vary by region and market conditions, but they illustrate the potential for renovations to enhance home value.

However, not all projects offer the same financial payoff. Luxurious additions like swimming pools, outdoor kitchens, or home theaters may increase personal enjoyment but often fail to recoup their full cost. In some cases, they can even limit the pool of potential buyers. The key is to align renovations with local market expectations. A high-end upgrade in a modest neighborhood may not attract proportionate offers. Conversely, bringing a home up to par with comparable properties can make it more competitive and appealing.

Beyond resale value, renovations contribute to long-term financial health by improving efficiency and reducing ongoing costs. Installing energy-efficient windows, insulation, or HVAC systems can lower utility bills year after year. Smart home technologies, such as programmable thermostats and water-saving fixtures, add convenience while conserving resources. These savings accumulate over time, effectively offsetting a portion of the initial investment.

Perhaps most importantly, a well-funded renovation supports overall wealth planning. By avoiding debt, preserving emergency savings, and maintaining investment accounts, homeowners protect their ability to meet future goals. Whether it’s funding a child’s education, preparing for retirement, or leaving a legacy, financial stability today enables greater freedom tomorrow. A renovation, when managed with discipline, becomes not a financial setback but a stepping stone toward long-term security.

A renovation isn’t just a home transformation—it’s a financial milestone. By planning comprehensively, respecting risk, and spending wisely, it’s possible to create the space you love without compromising your financial future. The real return isn’t just in square footage, but in confidence and control.